When applying for a mortgage, one of the most important factors that lenders consider is the Loan-to-Value Ratio (LVR). The LVR is a key metric that measures the size of your loan compared to the value of the property you are purchasing or refinancing. It plays a crucial role in determining how much you can borrow, whether you’ll need to pay lender’s mortgage insurance (LMI), and what interest rate you may qualify for.

In this article, we’ll explore why the loan-to-value ratio matters, how it can impact your home loan, and how to calculate it. Understanding LVR is an essential step in planning your home purchase or refinance, and it can help you make more informed decisions when navigating the mortgage process.

What Is Loan-to-Value Ratio (LVR)?

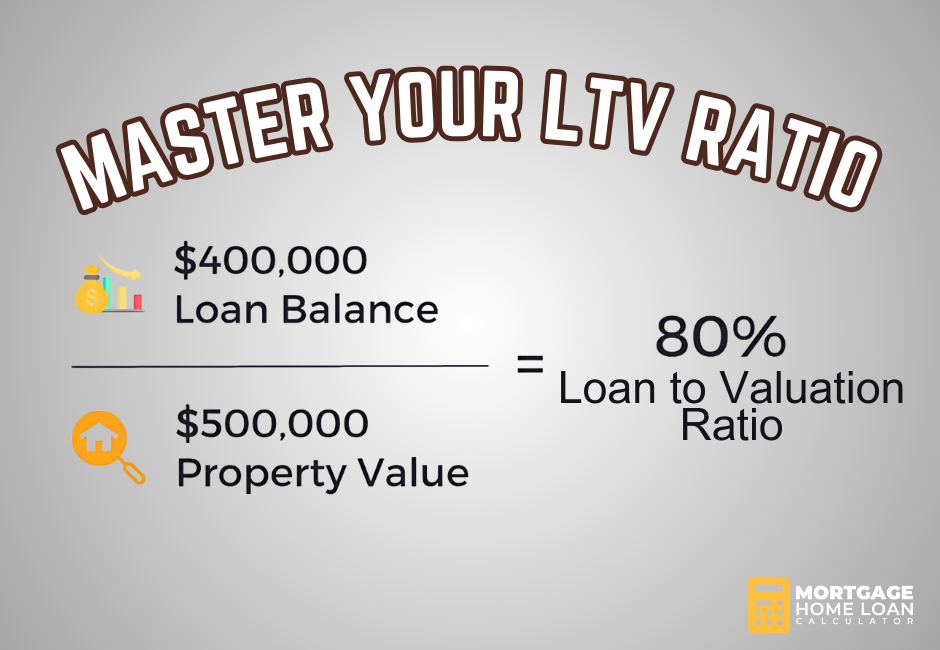

The Loan-to-Value Ratio (LVR) is a financial term that expresses the relationship between the loan amount and the value of the property. It is calculated as a percentage and helps lenders assess the level of risk involved in lending to you. The higher the LVR, the greater the risk to the lender, as they are financing a larger portion of the property’s value.

For example:

- If you’re borrowing $400,000 to purchase a property worth $500,000, your LVR is 80% ($400,000 ÷ $500,000 = 0.8, or 80%).

Lenders use LVR to evaluate the risk of default—if the LVR is high, there is a higher risk for the lender, and they may charge a higher interest rate or require Lender’s Mortgage Insurance (LMI) to mitigate that risk.

Why Loan-to-Value Ratio Matters

LVR is important for several reasons, as it affects the conditions of your loan and your ability to borrow. Let’s break down why LVR matters:

1. Loan Approval and Borrowing Power

Lenders typically set maximum LVR limits, which determine how much you can borrow based on the value of the property. For example, many lenders cap LVR at 80%, meaning you’ll need to provide at least a 20% deposit. If your LVR exceeds this threshold, the lender may still approve the loan, but additional conditions may apply, such as paying LMI.

2. Lender’s Mortgage Insurance (LMI)

If your LVR exceeds 80%, most lenders will require you to pay Lender’s Mortgage Insurance (LMI). LMI is a one-time insurance premium that protects the lender if you default on your loan. It can add a significant cost to your mortgage, but it enables borrowers to secure a loan with a lower deposit.

For example, if your LVR is 90%, you might be required to pay LMI, which could cost several thousand dollars depending on the loan amount and LVR. This cost can sometimes be added to the loan amount, increasing your overall mortgage balance.

3. Interest Rates

LVR also influences the interest rate you’ll be offered. Lenders often reserve their most competitive interest rates for borrowers with lower LVRs, as these borrowers are considered less risky. A lower LVR means you’re borrowing a smaller portion of the property’s value, which reduces the lender’s exposure.

In contrast, if your LVR is higher, you may face higher interest rates due to the increased risk to the lender.

4. Equity and Refinancing

Your LVR is not only relevant when you first purchase a property—it also matters when refinancing. The equity you’ve built in your home (the portion of the property you own outright) is the flip side of your LVR. As you pay down your loan or as the property’s value increases, your LVR decreases, and your equity grows.

When refinancing, lenders will assess your LVR to determine your eligibility for a new loan. A lower LVR means more equity and may allow you to refinance to a better interest rate or borrow against your home’s value for renovations or other purposes.

How to Calculate Your Loan-to-Value Ratio

Calculating your LVR is straightforward and involves dividing the loan amount by the value of the property, then multiplying by 100 to get a percentage. Here’s the formula:

Let’s look at an example to see how this works in practice:

Example 1: Purchasing a Property

You’re purchasing a home valued at $600,000, and you plan to borrow $480,000. To calculate your LVR:

In this case, your LVR is 80%, meaning you’ll avoid paying LMI as you’ve provided a 20% deposit.

Example 2: Refinancing Your Loan

You currently owe $350,000 on your home, which is now valued at $700,000. To calculate your LVR when refinancing:

With an LVR of 50%, you have significant equity in your property, and you may qualify for a lower interest rate or the option to borrow against your home’s value.

Key Considerations for LVR Calculations

- Property Value: The property’s value is determined by a formal valuation, which is usually conducted by the lender as part of the loan approval process. This value may differ from the purchase price or market value.

- Loan Amount: The loan amount includes the base loan as well as any additional costs that may be rolled into the mortgage, such as LMI (if applicable).

Managing Your Loan-to-Value Ratio

Understanding and managing your LVR is essential for improving your borrowing power and securing better loan terms. Here are some tips for managing your LVR:

1. Save for a Larger Deposit

One of the simplest ways to reduce your LVR is to save for a larger deposit. The more money you can put down upfront, the lower your LVR will be, which can help you avoid LMI and qualify for better interest rates.

For example, increasing your deposit from 10% to 20% reduces your LVR from 90% to 80%, which can save you thousands in LMI premiums and interest over the life of the loan.

2. Consider the Impact of LMI

If saving for a 20% deposit isn’t feasible, paying LMI may be a worthwhile trade-off to secure the loan. However, it’s important to weigh the cost of LMI against the benefits of purchasing a property sooner versus waiting to save for a larger deposit.

A mortgage calculator can help you estimate how much LMI you’ll need to pay based on your loan amount and LVR, giving you a clearer picture of the true cost of your mortgage.

3. Make Extra Repayments

Making extra repayments on your mortgage can help you reduce your LVR more quickly. As you pay down the principal, your loan balance decreases, which lowers your LVR and increases your equity. Over time, this can give you more flexibility to refinance or access a better interest rate.

4. Monitor Property Value Changes

The value of your property can fluctuate based on market conditions. If property values rise, your LVR may decrease even without additional repayments. Regularly reviewing the market value of your property can help you stay informed about your LVR and opportunities to refinance or leverage your equity.

How LVR Affects First-Time Homebuyers

For first-time homebuyers, understanding LVR is particularly important. Many first-time buyers are unable to save a full 20% deposit, which means their LVR is often higher than 80%. In these cases, lenders typically require LMI to reduce their risk.

However, there are some government grants and programs, such as First Home Buyer Grants, that can help reduce the deposit required for first-time buyers, lowering their LVR and helping them enter the property market sooner.

In some cases, lenders may also offer special loan products with higher LVR limits for first-time buyers, though these usually come with stricter criteria or higher interest rates.

Using a Mortgage Calculator to Estimate LVR and Loan Costs

A mortgage calculator can help you estimate your LVR and understand how it impacts your mortgage costs. Here’s how to use a mortgage calculator to plan for different LVR scenarios:

Step 1: Input Loan and Property Details

Start by entering the following information into the mortgage calculator:

- Loan amount: The amount you plan to borrow.

- Property value: The estimated or appraised value of the property.

- Interest rate: The rate offered by your lender (or an estimate).

The calculator will then display your estimated monthly repayments and total loan cost.

Step 2: Compare Different LVRs

Next, adjust the loan amount to see how different LVRs impact your repayments and total loan cost. For example, try calculating your loan with a 90% LVR (with a 10% deposit) versus an 80% LVR (with a 20% deposit). The calculator will show how much you can save by reducing your LVR.

Step 3: Estimate LMI Costs

Many mortgage calculators also allow you to input your LVR to estimate LMI costs. If your LVR exceeds 80%, the calculator will show how much LMI you’ll need to pay and how this impacts your overall loan balance.

Why LVR Is a Key Factor in Your Mortgage Decision

The Loan-to-Value Ratio (LVR) is a critical factor that affects your borrowing power, interest rates, and the need for Lender’s Mortgage Insurance (LMI). Understanding how to calculate and manage your LVR can help you make smarter financial decisions when purchasing a home or refinancing your mortgage.

By using a mortgage calculator, you can estimate your LVR, compare different loan scenarios, and understand how changes to your deposit or loan amount can impact your overall mortgage costs. Whether you’re a first-time buyer or an experienced homeowner, understanding LVR can save you money and help you secure better loan terms over the long term.